China Has Spent Hundreds of Billions on Its Own Loans to Bail Out Belt and Road Countries

The Lede: A new study reveals that China has spent $240 billion on emergency rescue lending to bail out 22 countries that are almost exclusively Belt and Road (BRI) project debtors.

What We Know:

- Research found that between 2008 and 2021, Chinese state-backed lenders distributed bailout funds to 22 countries including countries that also receive IMF support such as Argentina, Belarus, Ecuador, Egypt, Laos, Mongolia, Pakistan, Suriname, Sri Lanka, Turkey, Ukraine and Venezuela.

- Of the $240 billion in total bailout loans, $170 billion came from the PBOC’s swap line network directly with central banks to exchange currencies. The other $70 billion was lent by Chinese state-owned banks and enterprises.

- The increase in emergency financing from China for these countries since 2016 correlates with a drop in China’s lending for infrastructure projects that are part of the BRI. A number of BRI infrastructure projects have failed and debt problems have affected several recipient countries. The rising costs of servicing their loans have forced China to reassess its development goals.

- The average interest rate attached to a Chinese rescue loan was 5% compared to 2% for a typical rescue loan from the IMF.

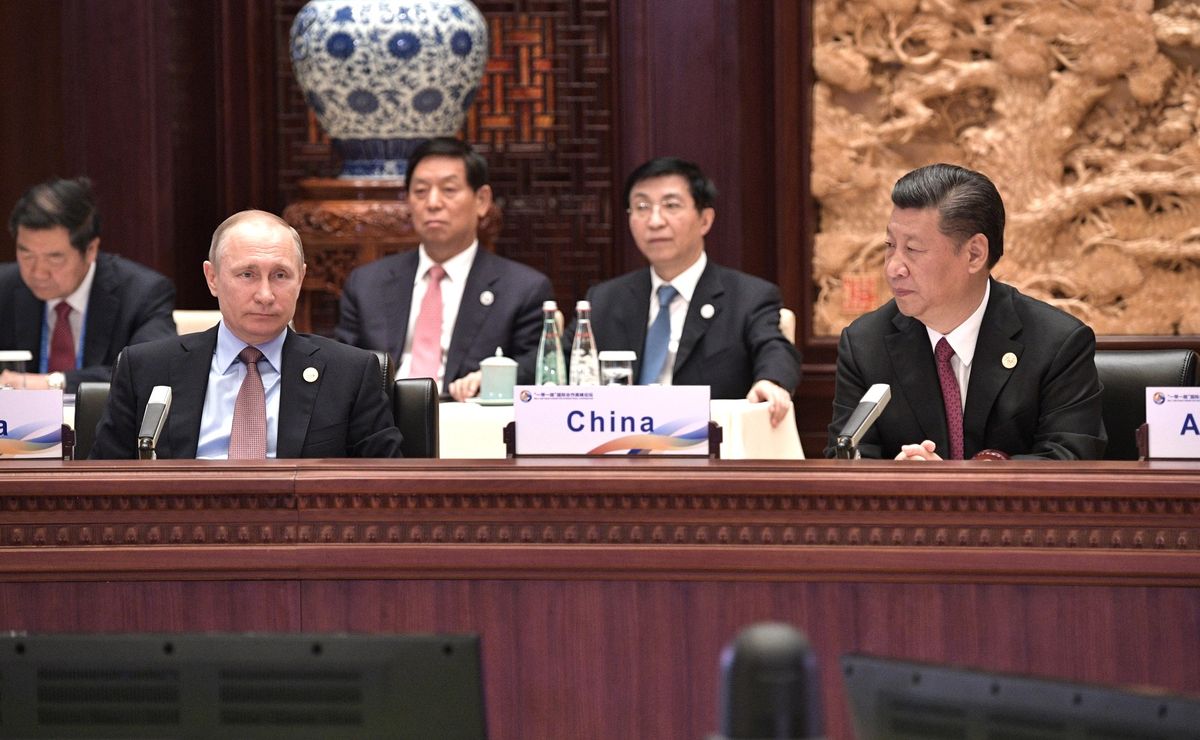

The Background: In the past decade, China has worked with governments across Asia, Africa, and Europe on its Belt and Road infrastructure megaproject that seeks to push Beijing’s global influence. China’s lending as part of these projects has made it into one of the world’s biggest creditor nations. While developing countries have typically taken loans with the IMF with an expectation of transparency, China’s loans are secretive and opaque with most operations and transactions kept away from the public.

Likely Outcomes:

- Despite the higher rates of interest associated with Chinese loans, some countries that demand financial assistance my turn to them as an alternative to loans from Western-led institutions like the IMF due to the unstable track record of success with those options and with the possibility to continuously roll over debt with China. Lawmakers in these cases may be tempted to take these loans in hopes that the debt will come due many years later under the watch of future policymakers.

- Chinese rescue lending is overwhelmingly sent to countries that already owe high levels of debt to China so the international bailouts also address the solvency of Chinese banks. This bailout trend may reflect deeper issues of solvency for BRI projects that can spell trouble for Chinese financial structures in the future if enough of the debtor countries end up defaulting on their debt. Chinese banks will likely end up offering extensive debt restructuring to these same countries in the future.

Quotables:

“Emergency rescue lending is a very risky business. If you bail out borrowers that are in default or teetering on the edge of default, the challenge is knowing whether your borrower faces a short-term liquidity problem or a long-term solvency problem”. – Bradley Parks, co-author of the AidData report

“Beijing is ultimately trying to rescue its own banks. That’s why it has gotten into the risky business of international bailout lending.” -- Carmen Reinhart, co-author of the AidData report

Good Reads:

China gave huge loans to Belt and Road countries. Now it’s spending billions to bail them out (CNN)

China spent $240bn on belt and road bailouts from 2008 to 2021, study finds (The Guardian)